Australia Power Bank Market Snapshot (2025)

Australia’s power bank market remains mature and growing steadily (CAGR ~6-8%), driven by high smartphone penetration (>80%), heavy data usage, multi-device ownership (wearables, earbuds, gaming handhelds), and demand for fast USB-C PD charging. How about the top 10 power bank brands in Austrailia?

Key consumer expectations: Quick multi-device charging, compact designs, airline compliance (UN38.3 <100Wh), and reliable safety amid rising recall awareness.

Retail remains highly concentrated and shelf-driven—shoppers often discover products in-store at major chains rather than online first.

Power bank displays in Australian retail stores like JB Hi-Fi and Harvey Norman:

Australia Power Bank Market Snapshot (2025)

The Australian portable battery pack market is mature but still growing, powered by:

- Very high smartphone penetration

- Heavy mobile data use

- Demand for fast USB-C PD charging

- More devices per user (wearables, earbuds, tablets, handheld gaming)

Consumers increasingly expect a power bank to charge multiple devices quickly, be compact, and be compliant with airline travel rules.

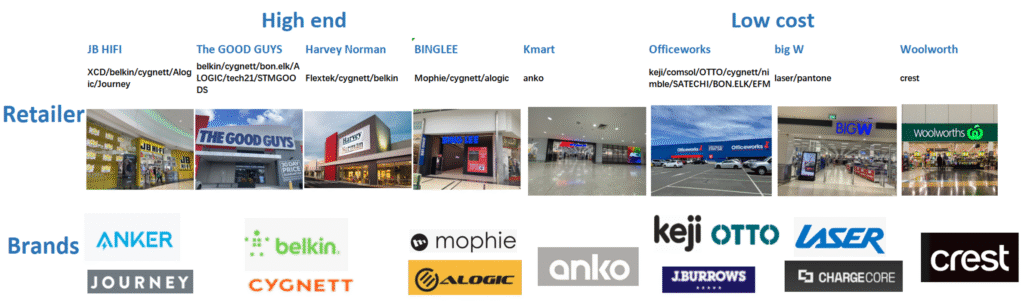

Highly Concentrated Retail Distribution

Power banks in Australia are mainly found through:

High-end consumer electronics (CE)

- JB Hi-Fi

- The Good Guys

- Harvey Norman

- Bing Lee

Value & mass channels

- Kmart

- Big W

- Officeworks

- Woolworths / Coles

High-End vs Value Channels – How Australia Sells Power Banks

1. High-End Consumer Electronics Retailers

These stores treat power banks as part of a premium accessory ecosystem.

Key attributes:

- Fast charging (USB-C PD 20W–65W)

- Wireless & MagSafe-style

- Premium materials

- Ecosystem matching (Apple / Samsung)

Why prices are higher:

Shoppers here want trust、aesthetics、warranty、brand reputation—and are willing to pay for it.

2. Value, Mass & Grocery Channels

Kmart, Officeworks, Big W and Woolworths play a volume game:

Channel characteristics:

- Sharp, everyday low price points

- Clear “5,000 / 10,000 / 20,000 mAh” labels

- Simple packaging

- Entry–mid tier focus under A$39 (high volume)

Power banks are positioned as daily essentials & impulse buys, not tech accessories.

How We Selected the Top 10 Brands

This ranking is based on factors that matter to Australian retail buyers:

Selection Criteria

- Retail coverage & physical shelf presence

- Product range depth (compact → high-capacity PD)

- Brand reputation & reviews

- Strategic relevance for B2B buyers

- Consistency in supply chain & quality

This is an independent overview to help retailers and importers plan assortments—not a paid promotion.

⭐ Top 10 Power Bank Brands in Australia (2025)

(Optimised for SEO + structured for retailer decision-making)

1. Anker — Global Fast-Charging Leader

Anker is Australia’s most recognised global power bank specialist.

Strengths:

- Top-tier fast-charging performance

- Strong reliability record

- Broad range from compact 5k to laptop-capable models

- Premium yet accessible

For retailers:

Anker is a premium anchor brand that increases category credibility and drives trade-up.

2. Cygnett — Australia’s Local Hero

A homegrown Australian brand with deep retail penetration.

Strengths:

- Strong understanding of AU price expectations

- Modern designs (incl. magnetic wireless)

- Excellent packaging & in-store appeal

Retail role:

Perfect mid-tier anchor brand with strong value-for-money perception.

3. Belkin — Trusted Global Accessory Brand

Belkin is widely distributed through CE and telco.

Strengths:

- Slim, reliable, Apple-friendly

- Strong ecosystem accessories

- High brand trust

Retail role:

Ideal for premium CE retailers wanting a clean, professional assortment.

4. Mophie — Premium, Design-Led Power

The lifestyle brand for design-conscious consumers.

Strengths:

- Magnetic wireless power

- Beautiful finishes & compact shapes

- Apple-centric appeal

Retail role:

Excellent for premium fixtures and impulse upgrades.

5. Alogic — Professional Charging & Connectivity

Alogic straddles consumer and professional segments.

Strengths:

- High-wattage USB-C PD

- Corporate/education ready

- Strong B2B credibility

Retail role:

Perfect bridge brand between CE and IT channels.

6. Samsung — Galaxy Ecosystem Power

Samsung sells power banks tailored to Galaxy users.

Strengths:

- Fast wireless

- Multi-device compatibility

- High device trust

Retail role:

Perfect add-on at telco stores and CE retailers.

7. Laser — Australian Value Brand

Laser is a strong local player in the value/mass tier.

Strengths:

- Affordable price points

- Broad SKU coverage

- Supermarket-friendly packaging

Retail role:

A flexible value option that balances margin and reliability.

8. Anko — Kmart’s Private Label

Kmart’s private-label powerhouse.

Strengths:

- Super competitive pricing

- Clear, simple designs

- Massive national distribution

Retail role:

Textbook example of how private label wins in the entry tier.

9. Grocery & DIY Brands (Crest, ChargeCore, etc.)

Found across supermarkets, DIY and auto channels.

Strengths:

- Entry-level pricing

- High-volume impulse sales

- Simple spec structure

Retail role:

Important for covering budget shoppers and impulse purchases.

10. Online Driven Brands (Baseus, RAVPower, etc.)

Aggressive online competitors influencing expectations.

Strengths:

- Very high specifications

- Attractive pricing

- Tech-savvy following

Retail role:

Set performance benchmarks that physical retailers must consider.

How Retailers Can Build a Winning AU Power Bank Range

1. Core Capacities + Pricing Strategy

- 10,000 mAh → highest volume

- 20,000 mAh → trade-up hero

- 5,000 mAh → compact & MagSafe

- 20,000–30,000 mAh PD → premium

Key price landmarks:

- Under A$39 → mass channels

- A$49–A$99 → high-end CE

- A$99+ → premium / MagSafe / laptop PD

2. Balanced Brand Architecture

A successful retailer assortment usually contains:

- Global premium brand → credibility

- Local hero brand → relevance

- Private label → margin & price control

This mix prevents fixture overcrowding and maximises shopper coverage.

3. Safety & Compliance

AU retailers are strict on:

- Cell quality

- BMS design

- UN38.3 & transport approvals

- Incident records

Poor-quality battery cells = high returns + real safety risk.

This is where your battery expertise is a huge competitive advantage.

Why Battery Cell Strategy Still Matters

Even famous brands can suffer recalls if their internal cell quality isn’t well controlled.

Retailers should evaluate:

- Chemistry (NCM vs LFP vs LCO for compact units)

- Cell supplier tier

- Multi-protection IC

- Thermal & charging stability

- Long-term reliability

This is the “invisible part” of the product that defines 80% of safety and performance.

How Reachinno Helps Retailers Compete with Top 10 Brands

Reachinno supports B2B clients with:

- AU-tuned private-label & exclusive SKUs

- Cell/matching strategy (NCM compact SKUs, LFP outdoor SKUs)

- Fast PD architecture

- Channel-specific lineups (CE, mass, grocery)

- Strong reliability & safety control

Our goal is to help partners meet big-brand standards—at a better cost structure.

FAQ

Q1: What are the most popular power bank brands in Australia?

Anker, Cygnett, Belkin, Mophie, Alogic, Samsung, Laser, Anko, Crest/ChargeCore, Baseus/RAVPower.

Q2: Which retailers sell which brands?

CE stores → Belkin, Cygnett, Mophie

Value/grocery → Anko, Laser, Crest

Online → Baseus, RAVPower, others

Q3: How to choose safe power banks for Australia?

Check cell chemistry, test reports, protection ICs and supplier quality systems.

Q4: Should retailers build private label?

Yes—if quality is well managed. It increases margin and control.

Q5: How to compete with global brands?

Specialise your assortment + ensure top-tier engineering + partner with a reliable ODM like Reachinno.