Why I’m Writing This (From Real Factory Experience)

As an OEM/ODM power bank engineer with over a decade in the industry at Reachinno, I’ve designed and shipped thousands of units for EU, US, and AU markets. I’ve dealt with everything from cell swelling in high-heat tests to optimizing BMS for PD 100W+ outputs. The eternal question—“18650 or 21700 for this power bank?”—isn’t just about specs. It’s a balance of power demands, fast charging protocols, cost pressures, certification risks (like UL/CB/KC), and market evolution over 15+ years.

This guide draws from hands-on experience: testing cycles, sourcing cells, and fixing field failures. It’s not armchair theory—it’s factory-floor reality, updated with 2025 data on prices, rankings, and trends.

A Short History: How Power Banks Created the Demand for Better Cells

Power banks didn’t emerge in isolation—they evolved alongside smartphones and charging tech. Here’s a refined timeline based on industry milestones:

- 2004–2006: Early Prototypes Emerge – Basic portable chargers for laptops and cameras appear, using NiMH or early Li-ion cells. Brands like GP Batteries pioneer commercial products.

- 2009–2010: Smartphone Boom Sparks the Industry – iPhone 3GS launches “battery anxiety.” Power banks become essential, starting with low-power (5V/1A) designs using imported Japanese cells like Panasonic/Sanyo.

- 2012–2014: Price Wars & Mass Adoption – Xiaomi and Romoss drive costs down. 18650 cells dominate; focus shifts to capacity hype (e.g., 20,000mAh) over efficiency.

- 2015–2017: Fast Charging Revolution – Qualcomm’s QC 2.0/3.0/4.0/4.1 demand higher currents, exposing 18650 limits in heat and aging.

- 2018–2020: Polymer & Compact Shifts – Slim designs favor pouch cells; magnetic/ultra-thin models rise, but with trade-offs in thermal margins.

- 2021–2025: 21700 Dominates High-Power – Driven by EVs (Tesla), 21700 enters consumer power banks for PD 45W–100W+. Ultra-fast charging and Qi wireless push cell evolution further.

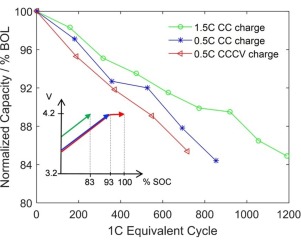

This evolution ties directly to battery stress from protocols—see the chart below for how fast charging amps up demands.

Fast-charging to a partial state of charge in lithium-ion batteries: A comparative ageing study – ScienceDirect

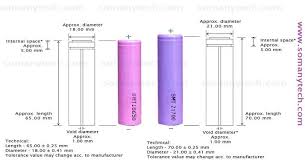

18650 vs 21700: Basic Physical Differences

At first glance, the size jump seems minor, but it transforms pack design. Here’s a quick comparison table:

| Cell Type | Size (mm) | Typical Capacity (mAh) | Energy Density Boost |

|---|---|---|---|

| 18650 | 18 × 65 | 2,400–3,500 | Baseline |

| 21700 | 21 × 70 | 4,000–5,000 | +20–30% |

Visualize the difference:

The larger 21700 fits more active material, enabling higher outputs without proportional size increases.

Energy Density & Efficiency: Why 21700 Changed the Game

From production tests: 21700 delivers 20–30% higher energy density, ~50% more capacity per cell, lower internal resistance, and superior thermal handling. This shines in modern power banks with PD 20W–100W+, where small cells face high stress. In EVs and tools, this means fewer cells for the same power, cutting costs and complexity.

Cycle Life: What the Industry Standard Really Means

Cycle life hits “end” at 80% capacity retention. Real data: 18650 lasts 300–500 cycles; 21700 hits 500–1,000 under similar loads. Why? Larger electrodes reduce current density, improving heat dissipation and longevity—crucial for fast-charging stress.

Why 21700 Is Better for High-Power Power Banks

In ODM projects, 18650 falters above 45W due to heat; 21700 excels at 65W–100W with lower stress, fewer cells, simpler BMS, and better certification margins. Ideal for laptop chargers.

When 18650 Still Makes Sense

For budget, moderate-power (under 45W), or slim designs, 18650 wins with proven chains and lower costs. Top models from Samsung SDI, LG, etc., remain reliable.

Common Battery Cell Brands Used in Power Banks

2025 global rankings emphasize EV giants, but power banks favor trusted consumer-grade suppliers. Top 10 overall: CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI, SK On, EVE Energy, CALB, Gotion, Sunwoda.

For power banks:

- Premium: Samsung SDI, LG Energy Solution, Panasonic/Sanyo, Sony/Murata

- Specialist: Molicel, EVE Energy

- Industrial: BAK, Lishen, Great Power, Sunpower

See this ecosystem map for consumer vs. EV splits:

EV Battery Market Size, Share, Forecast, Report, 2035

Cost Comparison in 2025

Retail: 18650 ($2.25–$7.99/cell), 21700 ($2.65–$8.99/cell). Wholesale: 18650 ~$1–$3, 21700 ~$2–$4. Market growth projects 18650/21700 at $20B+ by 2026, with 21700 gaining on efficiency.

How Fast Charging Protocols Pushed Cell Evolution

Protocols like QC 2.0/3.0 → PD 2.0/3.0/3.1 → Qi forced lower resistance and higher C-rates. 21700 handles this better, reducing failures.

My Practical Recommendation (From Real Projects)

- Pick 21700 for: High Wh/cell, fewer cells, superior life, PD 45W+ safety.

- Pick 18650 for: Low BOM, established supply, slim/moderate designs.

No universal “best”—match to product needs.

Final Takeaways

Power banks evolved with phones; 21700 addresses 18650’s limits in efficiency, heat, and mAh. Prioritize real metrics over hype.

About the Author: OEM/ODM Engineer at Reachinno. Hands-on with cells, protocols, and certifications. This reflects tested, shipped insights. For visuals or adaptations (e.g., LinkedIn posts, snippets), reach out!